UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | |

Filed by the Registrant ý |

|

Filed by a Party Other Than the Registrant o |

|

| Check the appropriate box: |

| |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12under §240.14a-12 |

FirstCash Holdings, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | |

Payment of Filing Fee (Check the appropriate box)all boxes that apply): |

| | | |

| ý | No fee required.required |

| o | Fee paid previously with preliminary materials |

| o | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

To the Stockholders of FirstCash Holdings, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders to be held at the Company’s corporate offices located at 1600 West 7th Street, Fort Worth, Texas 76102 at 10:00 a.m. CDT on Thursday,Wednesday, June 3, 2021.12, 2024.

The purpose of the meeting is (i) to elect a class of directors to serve a three-year term beginning in 2021,2024, (ii) to vote on the ratification of the selection of RSM US LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2021, and2024, (iii) to vote on a non-binding resolution to approve the compensation of the Company’s named executive officers.officers and (iv) to transact such other business as may properly come before the meeting.

We are pleased to take advantage of the Securities and Exchange Commission rules that allow the Company to furnish proxy materials to stockholders on the internet. These rules allow us to provide our stockholders with the information they need, while lowering the costs and reducing the environmental impact of our Annual Meeting and lowering costs.Meeting. Unless you previously requested a paper copy of our proxy materials, you will receive a Notice Regarding the Availability of Proxy Materials which tells you how to access the materials on the internet.

Whether or not you plan to attend the Annual Meeting, please vote by internet or telephone at your earliest convenience or complete and return your proxy card if you requested a paper copy of our materials. You may choose to attend the meeting and personally cast your votes even if you fill out and return a proxy card.

We hope that you will be able to join us at the FirstCash Holdings, Inc. Annual Meeting on June 3.12.

| | | | | |

| Very truly yours, |

| |

| Rick L. Wessel |

| Vice-Chairman of the Board and Chief Executive Officer |

| |

| Fort Worth, Texas | |

April 23, 202126, 2024 | |

FirstCash Holdings, Inc.

1600 West 7th Street

Fort Worth, Texas 76102

_______________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 3, 202112, 2024

The Annual Meeting (the “Annual Meeting”) of Stockholders of FirstCash Holdings, Inc. (the “Company”) will be held at the Company’s corporate offices located at 1600 West 7th Street, Fort Worth, Texas 76102 at 10:00 a.m. CDT on Thursday,Wednesday, June 3, 2021.*12, 2024.

The Annual Meeting is called for the following purposes:

| | | | | | | | |

| 1. | To elect Messrs. Rick L. Wessel, and James H. Graves and Douglas R. Rippel as directors of the Company for a three-year term beginning in 2021;2024; |

| | |

| 2. | To ratify the selection of RSM US LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2021;2024; |

| | |

| 3. | To vote on a non-binding resolution to approve the compensation of the Company’s named executive officers; and |

| | |

| 4. | To transact such other business as may properly come before the meeting. |

Stockholders of record at the close of business on April 12, 202122, 2024 will be entitled to notice of and to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to be held on June 3, 2021:12, 2024:

The Proxy Statement and the 20202023 Annual Report to Stockholders are available

at the Company’s website and can be accessed at www.firstcash.com, where a link to the Annual Report on Form 10-K is

available on the Investor Relations page of the website (investors.firstcash.com).

PLEASE USE INTERNET OR TELEPHONE VOTING OR COMPLETE AND RETURN A PROXY CARD SO THAT YOUR SHARES WILL BE REPRESENTED AT THE ANNUAL MEETING. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND PERSONALLY CAST YOUR VOTES AT THE ANNUAL MEETING.

| | | | | |

| By Order of the Board of Directors, |

| |

| R. Douglas Orr |

| Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

| |

| Fort Worth, Texas | |

April 23, 202126, 2024 | |

* As part of the Company’s precautions regarding the coronavirus or COVID-19, the Company is planning for the possibility that the Annual Meeting may be held by means of remote communication only (i.e., a virtual meeting). If the Company takes this step, or if the time, date or place of the Annual Meeting will be changing, the Company will announce the decision to do so in advance, and details on how to participate will be available on the Investor Relations page of the Company’s website (investors.firstcash.com).

TABLE OF CONTENTS

FirstCash Holdings, Inc.

1600 West 7th Street

Fort Worth, Texas 76102

_______________

PROXY STATEMENT

for

Annual Meeting of Stockholders

_______________

GENERAL INFORMATION

This Proxy Statement is being furnished to stockholders in connection with the solicitation of proxies by the Board of Directors (“BoardBoard” or “Board of Directors”) of FirstCash Holdings, Inc., a Delaware corporation (“FirstCash” or the “Company”), for use at the 20212024 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held at the Company’s corporate offices located at 1600 West 7th Street, Fort Worth, Texas 76102*76102 at 10:00 a.m. CDT, on Thursday,Wednesday, June 3, 2021,12, 2024, and at any adjournments thereof, for the purpose of considering and voting upon the matters set forth in the accompanying Notice of Annual Meeting of Stockholders (the “Notice”). The Company is mailing a printed copy of this Proxy Statement, a proxy card and the 20202023 Annual Report of the Company to certain of its registered stockholders who have not consented to electronic delivery of their proxy materials on or about April 23, 2021,26, 2024, and the Company is mailing a copy of a Notice of Internet Availability to all other stockholders on or about April 23, 2021.26, 2024.

The close of business on April 12, 202122, 2024 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. As of the record date, there were 41,027,42645,473,298 shares of the Company’s common stock, par value $.01 per share (“Common Stock”), issued and outstanding. The presence, in person or by proxy, of a majority of the outstanding shares of Common Stock on the record date is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes (described below) will be counted as present for the purposes of determining the presence of a quorum.

If your shares are held in the name of a broker, bank or other nominee, you are considered the “beneficial holder” of the shares held for you in what is known as “street name.” You are not the “record holder” of such shares. If this is the case, this Proxy Statement has been forwarded to you by your broker, bank or other nominee. As the beneficial holder, you generally have the right to direct your broker, bank or other nominee as to how to vote your shares by providing them with voting instructions.

If you do not provide voting instructions to your broker, bank or other nominee, the voting of your shares by the bank, broker or other nominee is governed by the rules of the Nasdaq Global Select Market (“Nasdaq”). These rules allow banks, brokers and other nominees to vote shares in their discretion on “routine” matters for which the “beneficial holder” does not provide voting instructions. On matters considered “non-routine,” banks, brokers and other nominees may not vote shares without your instruction. Shares that banks and brokers are not authorized to vote are referred to as “broker non-votes.”

If you do not instruct your bank, brokerage firm or other nominee in accordance with their directions how to vote your shares prior to the date of the Annual Meeting, your bank, brokerage firm or other nominee cannot vote your shares on the following proposals: “Proposal 1 - Election of Directors” andor “Proposal 3 - Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers,”Officers” and such shares will be considered “broker non-votes” and will not affect the outcome of these votes. However, your bank or brokerage firm may vote your shares in its discretion on “Proposal 2 - Ratification of Independent Registered Public Accounting Firm.”

* As part of the Company’s precautions regarding the coronavirus or COVID-19, the Company is planning for the possibility that the Annual Meeting may be held by means of remote communication only (i.e., a virtual meeting). If the Company takes this step, or if the time, date or place of the Annual Meeting will be changing, the Company will announce the decision to do so in advance, and details on how to participate will be available on the Investor Relations page of the Company’s website (investors.firstcash.com).

Each share of Common Stock is entitled to one vote on all questions requiring a stockholder vote at the Annual Meeting. The votes required to act on each proposal at the Annual Meeting are summarized below.

Proposal 1 — Election of Directors. A plurality of the votes of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for the approval of the election of directors under Proposal 1, as set forth in the accompanying Notice of Annual Meeting of Stockholders.Notice. Stockholders may not cumulate their votes in the election of directors. Abstentions and broker non-votes will have no effect in determining whether the proposal has been approved. The election of directors is also subject to the Company’s Director Election (Majority Voting) Policy, which is described below in the “Corporate Governance, Board Matters and Director Compensation” section of this Proxy Statement.

Proposal 2 — Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for the ratification of the selection of the Company’s independent public accountants under Proposal 2, as set forth in the accompanying Notice of Annual Meeting of Stockholders.Notice. Since this proposal is considered a routine matter, brokers will be permitted to vote shares without instruction as to this proposal, and there will be no broker non-votes with respect to this proposal. Abstentions will have the same effect as votes against Proposal 2.

Proposal 3 — Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers. The non-binding resolution to approve the compensation of the Company’s named executive officers will be approved if a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote isare voted in favor of the proposal. Broker non-votes will have no effect in determining whether the proposal has been approved. Abstentions will have the same effect as votes against Proposal 3.

Stockholder Proposals. If any stockholder proposal is properly presented at the Annual Meeting, the stockholder proposal will be approved if it receives the affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy and entitled to vote at the Annual Meeting. Broker non-votes will not be counted as having been entitled to vote on such a proposal, and will have no effect on the outcome of the vote on the proposal. Abstentions will have the same effect as votes against any stockholder proposal.

If you are a stockholder of record, you may vote in person at the Annual Meeting or by proxy without attending the Annual Meeting. You may vote by mail by signing, dating and returning your proxy card in the enclosed prepaid envelope. You may also vote over the internet or by telephone. The proxy card the Company mails you will instruct you on how to vote over the internet or by telephone. If you hold your shares in an account through a broker, bank or other nominee in “street name,” you should complete, sign and date the voting instruction card that your broker, bank or nominee provides to you or as your broker or bank nominee otherwise instructs.

Attendance at the Annual Meeting will be limited to stockholders of the Company (or their authorized representatives) as of the record date (or their authorized representatives).date. If you wish to attend the Annual Meeting in person, you will need to present a valid government-issued photo identification, such as a driver’s license or passport. Beneficial stockholders holding their shares through a broker, bank or other nominee in “street name” will need to bring proof of beneficial ownership as of the record date, such as a recent brokerage account statement, the voting instruction card provided by their broker, bank or other nominee or similar evidence of ownership. Stockholders of record will be verified against an official list available at the registration area. The Company reserves the right to deny admission to anyone who cannot show sufficient proof of stock ownership as of the record date.

All shares represented by properly executedproperly-executed proxies, unless such proxies previously have been revoked, will be voted at the Annual Meeting in accordance with the directions on the proxies. If no direction is indicated, the shares will be voted in accordance with the recommendation of the Board of Directors as follows: (i) TO ELECT MESSRS. RICK L. WESSEL, AND JAMES H. GRAVES AND DOUGLAS R. RIPPEL AS DIRECTORS; (ii) TO RATIFY THE SELECTION OF RSM US LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2021;2024; AND (iii) TO APPROVE THE ADVISORY PROPOSAL ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS. The designated proxies will vote in their discretion on any other matter that may properly come before the Annual Meeting. At this time, the Company is unaware of any matters, other than as set forth above, that may properly come before the Annual Meeting. The enclosed proxy, even though executed and returned, may be revoked at any time prior to the voting of the proxy (i) by the execution and submission of a revised proxy, (ii) by written notice to the Corporate Secretary of the Company or (iii) by voting in person at the Annual Meeting.

The Company’s primary corporate website is www.firstcash.com, where a link to the Annual Report on Form 10-K is available on the Investor Relations page of the website (investors.firstcash.com). The Annual Report on Form 10-K, covering the Company’s year ended December 31, 2020,2023, including audited financial statements, is enclosed herewith. The Annual Report on Form 10-K does not form any part of the material for solicitation of proxies.

The Company’s primary website is www.firstcash.com, where a link to the Annual Report on Form 10-K is available on the Investor Relations page of the website (investors.firstcash.com). The Company will provide, without charge, a printed copy of its Annual Report on Form 10-K upon written request to the Corporate Secretary, at 1600 West 7th Street, Fort Worth, Texas 76102. The Company will provide exhibits to its Annual Report on Form 10-K, uponUpon payment of the reasonable expenses incurred by the Company in furnishing such exhibits.exhibits, the Company will provide exhibits to its Annual Report on Form 10-K.

PROPOSAL 1

ELECTION OF DIRECTORS

The Bylawsbylaws of the Company (the “bylaws”) provide that the Board of Directors will determine the number of directors but shall consist of at least one director and no more than 15 directors. The stockholders of the Company elect the directors. At each annual meeting of the stockholders of the Company, successors of the class of directors whose term expires at the annual meeting will be elected for a three-year term. Any director elected to fill a vacancy or newly creatednewly-created directorship resulting from an increase in the authorized number of directors shall hold office for a term that shall coincide with the remaining term of that class. In no case will a decrease in the number of directors shorten the term of any incumbent director. Any vacancy on the Board of Directors, however resulting, may be filled by a majority of the directors then in office, even if less than a quorum, or by a sole remaining director.

Unless otherwise instructed or unless authority to vote is withheld, the enclosed proxy will be voted for the election of the nominees listed herein. Although the Board of Directors does not contemplate that the nominees will be unable to serve, if such a situation arises prior to the Annual Meeting, the person named in the enclosed proxy will vote for the election of such other person as may be nominated by the Board of Directors.

The Board of Directors currently consists of sevennine directors, following the appointmentsix of Ms. Paula K. Garrett to the Board of Directors effective January 1, 2021. Five of the directorswhom are independent. The current directors areindependent, as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Principal Occupation | | | | | | | | | | | | | | | | | | Independence Status |

Name | | Age | | Principal Occupation | | Independence Status |

| Daniel R. Feehan | | 73 | | 70 | Chairman of the Board, FirstCash Holdings, Inc. | | Employee |

| Rick L. Wessel | | 65 | | 62 | Vice-Chairman of the Board and CEO, FirstCash Holdings, Inc. | | Employee |

| Mikel D. Faulkner | | 74 | | Former Executive Chairman, Nautilus Marine Services PLC | | Lead Independent Director |

| Daniel E. Berce | | 70 | | 67 | President and CEO, General Motors Financial Company, Inc. | | Independent Director |

Mikel D. FaulknerMarthea Davis | | 45 | | 71Independent Corporate Communications Advisor | | Former Executive Chairman, Nautilus Marine Services PLC | | Lead Independent Director |

| Paula K. Garrett | | 63 | | 60 | Former Vice-President of Finance, Operations and Information System Technology for the Latin America Region, Mary Kay, Inc. | | Independent Director |

| James H. Graves | | 75 | | 72 | Managing Director and Partner, Erwin, Graves & Associates, LP | | Independent Director |

| Randel G. Owen | | 65 | | 62 | Former President and CEO, Global Medical Response | | Independent Director |

| Douglas R. Rippel | | 57 | | Former owner and CEO of American First Finance | | Director |

Biographical information for the directors is as follows:

Daniel R. Feehan has served as chairman of the Board of Directors of FirstCash since the Company’s 2016 merger (the “Merger”) with Cash America International, Inc. (“Cash America”) and previously. Previously, Mr. Feehan served as a director and executive chairman of Cash America director since 1984. Mr. Feehan was Cash America’s executive chairman sincefrom November 1, 2015 until the completionMerger. Mr. Feehan served as the chief executive officer of the Merger.Cash America from February 2000 to November 2015. Prior to that, Mr. Feehan served asin other executive management roles at Cash America’s chief executive officer and president from February 2000 through May 2015 and as Cash America’s chief executive officer from May 2015 through October 2015, when he retired from that position. Mr. Feehan served as Cash America’sAmerica, including president and chief operating officer from January 1990 until February 2000, except that he served as chairman and co-chief executive officer of one of Cash America’s subsidiaries from February 1998 to February 1999 before returning to the position of Cash America’s president and chief operating officer. Mr. Feehan became a Cash America director in 1984 and joined Cash America full-time in 1988, serving as its chief financial officer, before becoming president and chief operating officerthe first of which roles began in 1990. Mr. Feehan also currently serves as chairman of the chairman atboard of AZZ Inc. (NYSE: AZZ), a NYSE listed equipment manufacturing company,provider of galvanizing and coil coating solutions. Mr. Feehan serves as a director of Enova International, Inc. (NYSE: ENVA), an online lending company that was spun off from Cash America in 20142014. In addition, Mr. Feehan serves as a director of a number of private companies and is listed oncharitable organizations, including the NYSE, where heLena Pope Home and One Safe Place. In December 2019, Texas Governor Greg Abbott appointed Mr. Feehan to the Board of Regents of the University of North Texas System. Mr. Feehan received a Bachelor of Business Administration degree in Accounting from Texas A&M University and has served since 2000 and 2011, respectively.been recognized as a Distinguished Alumnus of that institution.

Rick L. Wessel has served as vice-chairman of the Board of Directors of the Company since September 2016, as chief executive officer since November 2006 and has been a director since November 1992. Mr. Wessel previously served as president from May 1998 to September 2016, chairman of the boardBoard of Directors from October 2010 to September 2016, vice-chairman of the boardBoard of Directors from November 2004 to October 2010, and secretary and treasurer of the Company from May 1992 to November 2006 and the Company’s chief financial officer of the Company from May 1992 to December 2002. Prior to February 1992, Mr. Wessel was employed by Price Waterhouse LLP for approximately nine years.

Daniel E. Berce has served as a director of FirstCash since the Merger in 2016 and previously served as a Cash America director since 2006. Mr. Berce has been president and chief executive officer of General Motors Financial Company, Inc. (formerly AmeriCredit Corp.) since its acquisition by General Motors Company in October 2010. Mr. Berce served as AmeriCredit Corp.’s chief executive officer from August 2005 to October 2010, president from April 2003 to October 2010 and vice-chairman and chief financial officer from November 1996 until April 2003. He served as a director at AmeriCredit Corp. from November 1990 to October 2010. Mr. Berce currently serves as a director at AZZ Inc., a NYSE listed equipment manufacturing company, and chairman at Arlington Asset Investment Corp., a NYSE listed investment company.

Mikel D. Faulkner was appointed to the Board of Directors in 2009 and has served as the lead independent director since October 2017. From February 2017 to February 2019, Mr. Faulkner served as executive chairman of the board of directors of Nautilus Marine Services PLC, an investment company focused on the global offshore services industry and quoted on the London Stock Exchange (AIM). From 2002 to February 2017, Mr. Faulkner served as executive chairman of the board of directors of Global Energy Development PLC, an international oil and gas exploration company, quoted on the London Stock Exchange (AIM). Mr. Faulkner served as chief executive officer of HKN, Inc. (ASE: HKNI) from 1982 to 2017, chairman of HKN, Inc. from 1991 to 2003 and president and chief executive officer of HKN, Inc. from 2003 to 2017. HKN, Inc., formerly Harken Energy Corporation (NYSE), was an independent energy company.

Daniel E. Berce has served as a director of FirstCash since the Merger in 2016 and previously served as a Cash America director from 2006 to 2016. Mr. Berce has been president and chief executive officer of General Motors Financial Company, Inc. (formerly AmeriCredit Corp.) since its acquisition by General Motors Company in October 2010. Mr. Berce served as AmeriCredit Corp.’s chief executive officer from August 2005 to October 2010, president from April 2003 to October 2010 and vice-chairman and chief financial officer from November 1996 until April 2003. Mr. Berce served as a director at AmeriCredit Corp. from November 1990 to October 2010. Mr. Berce currently serves as a director at AZZ Inc. (NYSE: AZZ), a provider of galvanizing and coil coating solutions.

Marthea Davis was elected to the Board of Directors in June 2022. Ms. Davis is an independent corporate communications advisor. She was a director at TrailRunner International from 2020 to 2024 and a strategic communications director at EnerGeo Alliance from 2019 to 2020. Ms. Davis managed corporate communications for Houston First Corporation from 2017 to 2019, overseeing key convention, arts and entertainment venues in Houston, TX. Earlier in her career, she held various roles in communications and public relations across diverse sectors, including civil rights, cryptocurrency, education, legal and energy. A graduate of Howard University, Ms. Davis brings over 20 years of experience in public relations, strategic communications, government affairs and crisis management.

Paula K. Garrett was appointed to the Board of Directors in January of 2021. From 2005 until her retirement in 2023, Ms. Garrett servesserved as the vice president of finance, operations and information system technology for the Latin America region of Mary Kay, Inc. (“Mary Kay”), a position she has held since 2005.multibillion-dollar direct selling beauty company. In this role, she leadsled the financial, operational, technology and other market development functions for all of Mary Kay’s Latin America markets, which includeincluding Mexico, Brazil, Argentina, Uruguay, Colombia and Peru. Mary Kay is a multibillion-dollar direct selling beauty company with millions of independent sales force members in nearly 40 markets worldwide. From 1999 to 2004, Ms. Garrett previously held roles at Mary Kay as region controller, Latin America and internal audit project manager. Ms. Garrett’s employment experience also includes service as internal audit manager of Oryx Energy Company from 1998 to 1999 and experience in a progression of accounting and internal audit positions from 1984 to 1998.

James H. Graves has served as a director of FirstCash since the Merger in 2016 and previously served as a Cash America director since 1996.from 1996 to 2016. Mr. Graves has served as managing director and partner of Erwin, Graves & Associates, LP, a management consulting firm located in Dallas, Texas, since January 2001. Mr. Graves also served as executive vice president of financial strategy for DeviceFidelity, Inc., a financial services technology company, from March 2008 through September 2012. Mr. Graves served as a director, vice-chairman of the board of directors and chief operating officer of Detwiler, Mitchell & Co., a Boston-based securities research firm, from June 2002 until June 2006. Prior to that, Mr. Graves held various positions, including chief operating officer, with J.C. Bradford & Company, a Nashville-based securities firm. HeMr. Graves also worked for Dean Witter Reynolds, Inc. as the head of the energy group and later as head of the industry investment banking groups in New York. Mr. Graves currently servespreviously served as a director at Hallmark Financial Services, Inc., a publicly traded insurance company, serving sincefrom 1995 to June 2022, as a director of Atlantic Capital Bancshares, Inc., a publicly traded bank holding company, serving sincefrom 2017 to March 2022, and he previously served as a director of Tristate Capital Holdings, Inc., a publicly traded bank holding company, serving from 2011 through July 2015. Mr. Graves also serves as a director of various privately-held companies, including a private equity fund and a healthcare technology company.

Randel G. Owen was appointed to the Board of Directors in 2009. InFrom March 2018 to December 2022, Mr. Owen was namedserved as president and chief executive officer of Global Medical Response, an industry-leading air, ground, specialty and residential fire services and managed medical transportation organization. From July 1999 to March 2018, he previouslyMr. Owen held roles as president of ambulatory services, chief financial officer and executive vice president of Envision Healthcare Corporation, a large, privately-heldpublicly-held healthcare company and national hospital-based physician group,emergency services provider business, and its predecessor companies including AMRAmerican Medical Response (“AMR”) and EmCare. HeEmCare Holdings Inc. (“EmCare”). Mr. Owen was appointed executive vice president and chief financial officer of AMR in March 2003. HeMr. Owen joined EmCare in July 1999 and served as executive vice president and chief financial officer from June 2001 to March 2003. Before joining EmCare, Mr. Owen was vice president of Group Financial Operations for PhyCor, Inc. from 1995 to 1999. Mr. Owen has more than 3035 years of financial experience in the health carehealthcare industry.

Douglas R. Rippel was appointed to the Board of Directors in December of 2021. Mr. Rippel is the founder of American First Finance (“AFF”) and served as its chief executive officer from 2013 to February 2021 and its executive chairman from 2013 until AFF was acquired by FirstCash in 2021. Mr. Rippel previously served as chief executive officer of CURO Holding Corp (OTC: CURO) from 1997 to 2012 and was chairman of the board of directors from 2008 to 2012 and then executive chairman of the board of directors from 2012 to January 2022.

There are no family relationships betweenamong any directordirectors or executive officers.

Director Terms

The seven directors are divided into three classes. At each annual meeting of stockholders, one class is elected to hold office for a term of three years. Directors serve until the earlier of (i) their death, resignation, retirement, removal or disqualification, or (ii) until their successor is elected and qualified. The directors standing for election at the Annual Meeting are Messrs. Rick L. Wessel, and James H. Graves.Graves and Douglas R. Rippel. Mr. Daniel R. Feehan, Ms. Marthea Davis and Ms. Paula K. Garrett will next stand for election in 2022.2025. Messrs. Daniel E. Berce, Mikel D. Faulkner and Randel G. Owen will next stand for election in 2023.2026.

Required Vote

Proxies will be voted for the election of Messrs. Rick L. Wessel, and James H. Graves and Douglas R. Rippel as directors of the Company unless otherwise specified in the proxy. A plurality of the votes cast byof the holders of shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote will be necessary to elect the nominees as directors. If, for any reason, any nominee is unable or unwilling to serve, the proxies will be voted for a substitute nominee who will be designated by the Board of Directors at the Annual Meeting. Stockholders may abstain from voting by marking the appropriate boxes on the accompanying proxy. Abstentions will be counted separately and used for purposes of calculating whether a quorum is present at the Annual Meeting. The Company has adopted a majority voting policy for non-contested director elections, which is described below in the “Corporate Governance, Board Matters and Director Compensation” section.

Recommendation of the Board of Directors

Based on the respective nominees’ experience, the Nominating and Corporate Governance Committee of the Board of Directors and the entire Board of Directors unanimously recommendsrecommend a vote “FOR” the election of Messrs. Rick L. Wessel, and James H. Graves and Douglas R. Rippel as directors of the Company.

CORPORATE GOVERNANCE, BOARD MATTERS AND DIRECTOR COMPENSATION

Board of Directors, Committees and Meetings

The Board of Directors held fivefour meetings during the year ended December 31, 2020.2023 and acted one time by written consent. Each director attended, either telephonicallyvirtually or in person, at least 75% of the meetings of the Board of Directors during their respective terms. Members of the Board of Directors are encouraged to attend the Company’s Annual Meeting; however, attendance is not mandatory. Messrs. Wessel and FeehanNo members of the Board of Directors attended last year’s Annual Meeting. In addition, the independent directors of the Company meet separately in executive sessions after regularly scheduledregularly-scheduled meetings of the Board of Directors and more frequently as deemed appropriate by the independent directors.

During 2020, all of the independent directors (Messrs. Berce, Faulkner, Graves and Owen) served as members of the Audit, Compensation and Nominating and Governance Committees. The chairperson for each committee during 2020 was as follows:

•Audit Committee - Mr. Berce

•Compensation Committee - Mr. Owen for the period from January 1, 2020 to July 20, 2020 and Mr. Graves for the period from July 21, 2020 to December 31, 2020

•Nominating and Corporate Governance Committee - Mr. Graves from January 1, 2020 to July 20, 2020 and Mr. Owen from July 21, 2020 to December 31, 2020

During 2020,2023, each committee member attended, either telephonicallyvirtually or in person, at least 75% of the meetings of their respective committees. During 2020,2023, the Audit Committee held four meetings, the Compensation Committee held fivethree meetings and the Nominating and Corporate Governance Committee held four meetings.one meeting.

Following Ms. Paula K. Garrett’s appointment to the BoardDuring 2023, and as of Directors on January 1, 2021,today, the committees were reconstitutedare composed as follows:

| | | | | | | | | | | | | | | | | | | | |

| Independent Director | | Audit | | Compensation | | | | | | | | | | | | | | | | | | Nominating

and

Corporate

Governance |

Independent Director | | Audit | | Compensation | | Nominating

and

Corporate

Governance |

| Mikel D. Faulkner (Lead Independent Director) | | | | l | | | l | | l |

| Daniel E. Berce | | Chair | | Chairl | | |

| Marthea Davis | | | | | | l | | |

| Paula K. Garrett | | l | | l | | | |

| James H. Graves | | | | Chair | | | Chair | | l |

| Randel G. Owen | | l | | l | | | Chair |

Board Committees

Audit Committee. The Audit Committee is responsible for the oversight of the Company’s accounting and financial reporting processes. This includes the selection and engagement of the Company’s independent registered public accounting firm and review of the scope of the annual audit, audit fees and results of the audit. The Audit Committee reviews and discusses with management and the Board of Directors such matters as accounting policies, internal accounting controls, procedures for preparation of financial statements and other financial disclosures, scope of the audit, the audit plan and the independence of such accountants. In addition, the Audit Committee has oversight over the Company’s internal audit and regulatory compliance functions.functions and its cybersecurity program. The Board of Directors has determined that all memberseach member of the Audit Committee qualifyqualifies as an audit“audit committee financial expertexpert” as defined by Item 401(h) of Regulation S-K promulgated under the Securities Act of 1933, as amended (“Securities Act”), and the Securities Exchange Act of 1934, as amended (“Exchange Act”). The Board of Directors has adopted a charter for the Audit Committee, which is available to stockholders as described below.below and is reviewed annually.

Compensation Committee. The Compensation Committee is responsible for reviewing and approving corporate goals and objectives relevant to the compensation of the Company’s CEO,Chief Executive Officer (“CEO”), evaluating the CEO’s performance in light of those goals and objectives, and recommending to the Board of Directors for approval of the CEO’s compensation. The Compensation Committee is also responsible for recommending to the Board of Directors for approval the compensation of all other executive officers of the Company. In addition, the Compensation Committee oversees and approves grants and awards under the Company’s equity-based plans, incentive compensation plans and tax-qualified employee benefit plans, and approves severance and other termination payments to executive officers.

The Board of Directors has adopted a charter for the Compensation Committee, which is available to stockholders as described below.below and is reviewed annually. Pursuant to its charter, the Compensation Committee may delegate all or a portion of its duties and responsibilities to one or more subcommittees consisting of one or more of its members. For more information regarding the Compensation Committee’s processprocesses and procedures for consideration of executive compensation, see “Compensation Discussion and Analysis.”

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for making recommendations to the Board of Directors concerning the governance structure and practices of the Company, including the size of the Board of Directors and the size and composition of various committees of the Board of Directors. In addition, the Nominating and Corporate Governance Committee is responsible for identifying individuals believed to be qualified to become directors, and to recommend to the Board of Directors the nominees to stand for election as directors at the Annual Meeting of Stockholders. The Board of Directors has adopted a charter for the Nominating and Corporate Governance Committee, which was revised in April 2020. The charter is available to stockholders as described below.below and is reviewed annually.

The Board of Directors has determined that each member of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee is independent under the listing standards of Nasdaq, the SECSecurities and Exchange Commission (“SEC”) rules and the Company’s Corporate Governance Guidelines. Each of the Company’s committee charters is publicly available and can be accessed on the Investor Relations page of the Company’s website at investors.firstcash.com. Copies of the Company’s committee charters are also available, free of charge, by submitting a written request to the Corporate Secretary, at 1600 West 7th Street, Fort Worth, Texas 76102.

Directors’ Compensation

The Board of Directors reviews director compensation on a periodic basis. Such reviews include collecting and analyzing benchmarking information from compensation advisory firms regarding the amount and structure of the Company’s director compensation as compared to its peers. The Board of Directors determined the compensation for independentnon-employee directors for 20202023 would be structured as follows:

•Annual cash compensation of $100,000, paid in quarterly installments of $25,000$25,000;

•A grant of 1,3431,503 restricted stock units,awards valued at $114,061$138,547 on the date of grant, January 28, 2020,February 1, 2023, which fully vested on December 31, 20202023; and

•Supplemental annual cash payments of $25,000 to the lead independent director, $25,000 to the Audit Committee chairman, $20,000 to the Compensation Committee chairman and $15,000 to the Nominating and Corporate Governance Committee chairman. All amounts arechairman, all paid in quarterly installments.

The Board of Directors believes the mix of cash and equity compensation provides a balance between short-term cash compensation and long-term compensation tied to the Company’s stock price performance and serves to match the interests of the Company’s independentnon-employee directors with those of stockholders. Based upon benchmark data of the Company’s 20202023 Peer Group (as defined and discussed in the “Compensation DiscussionsDiscussion and Analysis”) herein), the Board of Directors also believes the total director compensation and the mix of compensation is within the competitive range of such compensation for the companies in the 20202023 Peer Group.

For the year ended December 31, 2020,2023, the independentnon-employee directors received compensation for service as a director as described above. ThereWhile there are no supplemental payments for attending the meetings of the Board of Directors and committee meetings. In addition,meetings, the directors were reimbursed for their reasonable expenses incurred for each Board of Directors and committee meetingsmeeting attended. The Company only compensates independent non-employee directors for their services as directors. The compensation paid to Mr. Feehan is described below, and the compensation paid to Mr. Wessel is described in the “Compensation Discussion and Analysis” section of this Proxy Statement.

The following table presents information regarding the compensation paid to the independentnon-employee directors and to Mr. Feehan for the year ended December 31, 2020:2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash

$ | | Stock Awards

$ | | All Other Compensation

$ | | Total

$ |

| Daniel E. Berce | | 125,000 | | | 114,061 | | | — | | | 239,061 | |

| Mikel D. Faulkner | | 125,000 | | | 114,061 | | | — | | | 239,061 | |

| | | | | | | | |

| James H. Graves | | 117,500 | | | 114,061 | | | — | | | 231,561 | |

| Randel G. Owen | | 117,500 | | | 114,061 | | | — | | | 231,561 | |

Daniel R. Feehan (1) | | — | | | — | | | 300,000 | | | 300,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash

$ | | Stock Awards

$ | | All Other Compensation

$ | | Total

$ |

Daniel R. Feehan (1) | | — | | | — | | | 300,000 | | | 300,000 | |

| Daniel E. Berce | | 125,000 | | | 138,547 | | | — | | | 263,547 | |

| Marthea Davis | | 100,000 | | | 138,547 | | | — | | | 238,547 | |

| Mikel D. Faulkner | | 125,000 | | | 138,547 | | | — | | | 263,547 | |

| Paula K. Garrett | | 100,000 | | | 138,547 | | | — | | | 238,547 | |

| James H. Graves | | 120,000 | | | 138,547 | | | — | | | 258,547 | |

| Randel G. Owen | | 115,000 | | | 138,547 | | | — | | | 253,547 | |

| Douglas R. Rippel | | 100,000 | | | 138,547 | | | — | | | 238,547 | |

(1)Mr. Feehan currently serves as the chairman of the Board of Directors of the Company. Mr. Feehan also served in 20202023 as a non-executive employee of the Company pursuant to anhis employment agreement dated January 28, 2020, which is filed as Exhibit 10.16 to the Company’s Annual Report on Form 10-K filed with the SEC on February 3, 2020. For a description of Mr. Feehan’s current employment agreement, see “Feehan Employment Agreement” below.agreement. The compensation reported represents his salary during the year ended December 31, 2020.2023. In addition, the Company paid for certain standard employee benefit programs for Mr. Feehan, including participation in group health and welfare and retirement benefit plans, which are generally available to all employees.

For 2021,2024, the compensation structurecash and amountsstock-based compensation for the independentnon-employee directors and Mr. Feehan will remain the same as 2020.materially consistent with 2023.

Feehan Employment Agreement

In January of 2020, theThe Company’s chairman of the Board of Directors, Mr. Feehan, entered into a new employment agreement with the Company. The agreement, which wasCompany effective January 1, 2020 and2024 (the “2024 Agreement”) which replaces the previous employment agreement that expired on December 31, 2023. The 2024 Agreement has a three-year term which ends on December 31, 2023, provides2026, providing Mr. Feehan with an annual cash salary of $300,000$450,000 and the right to participate in all of the Company’s savings, retirement and welfare benefit plans available to other employees of the Company. Mr. Feehan is not entitled to bonuses, equity grants or other director compensation under this agreement.the 2024 Agreement.

The agreement2024 Agreement provides that if Mr. Feehan’s employment with the Company is terminated during the term by the Company without “cause” or by the executive for “good reason” (as such terms are defined in thesuch employment agreement), Mr. Feehan would be entitled to a lump sum cash severance payment equal to one times (or two times, if such termination occurs within twelve months following a change in control of the Company) his salary in effect as of the termination. HeMr. Feehan would also be entitled to continue to participate in the Company’s health and welfare benefit plans at active employee rates for a period of eighteen months (the “COBRA subsidy”). Furthermore, if such termination occurs within twelve months following a change in control of the Company, the Company will pay to the executive,Mr. Feehan, in lieu of the COBRA subsidy described above, a lump sum in cash in an amount equal to the full monthly cost of health and welfare benefit coverage multiplied by 24.

The agreement2024 Agreement prohibits Mr. Feehan from competing with the Company during the employment term and for a period of 24 months following termination of employment. Mr. Feehan is also prohibited from soliciting customers of the Company and from recruiting Company employees during this period.

Code of Business Conduct and Ethics

The Code of Business Conduct and Ethics is publicly available and can be accessed on the Company’s website at www.firstcash.com. The Company intends to disclose future amendments to, or waivers from, certain provisions of its Code of Business Conduct and Ethics on its website (investors.firstcash.com) in accordance with applicable Nasdaq and SEC requirements. Copies of the Company’s Code of Business Conduct and Ethics are also available, free of charge, by submitting a written request to FirstCash Holdings, Inc., Investor Relations, 1600 West 7th7th Street, Fort Worth, Texas 76102.

Stock Ownership Guidelines for Directors

In an effort to further align the interests of the directors with the interests of stockholders, the Company adopted amaintains stock ownership guidelineguidelines for non-employee directors which became effective beginning in 2017.directors. The guideline calls for stock ownership (including the value of non-vested restricted stock units “RSU’s”)awards) having a value equal to five times each director’s annual cash retainer with a five-year accumulation period to fully comply with the guideline once a director becomes subject to the guideline. As of April 12, 2021,22, 2024, all five independentnon-employee directors have either met the ownership guideline or have additional time to meet the guideline. Directors who have not met the guideline must retain their vested stock awards until they meet the guideline. While the guidelines doguideline does not apply to employee directors, the current stock ownership of the two employee directors would meet the guidelines if calculated at five times theirthe employees’ annual salary as an employee of the Company.salary.

Director Election (Majority Voting) Policy

The Company has adopted a Director Election (Majority Voting) Policy. Pursuant to this policy, in an uncontested election of directors (that is, an election where the number of nominees is equal to the number of seats open), any nominee for director who receives a greater number of “WITHHOLD” votes than “FOR” votes for his election must promptly submit an offer of resignation to the Nominating and Corporate Governance Committee following the certification of the stockholder vote for consideration, in accordance with the following procedures.

The Nominating and Corporate Governance Committee will consider any tendered resignation and, promptly following the date of the stockholders’ meeting at which the election occurred, will make a recommendation to the Board of Directors concerning the acceptance or rejection of such resignation. In determining its recommendation to the Board of Directors, the Nominating and Corporate Governance Committee will consider all factors deemed relevant by the members of the Nominating and Corporate Governance Committee, including, without limitation, the stated reason or reasons why stockholders who cast “withhold” votes for the director did so, the qualifications of the director (including, for example, the impact the director’s resignation would have on the Company’s compliance with the requirements of the SEC and the rules of Nasdaq), and whether the director’s resignation from the Board of Directors would be in the best interests of the Company and its stockholders.

The Nominating and Corporate Governance Committee will also will consider a range of possible alternatives concerning the director’s tendered resignation as members of the committee deem appropriate, including, without limitation, acceptance of the resignation, rejection of the resignation, or rejection of the resignation coupled with a commitment to seek to address and cure the underlying reasons reasonably believed by the Nominating and Corporate Governance Committee to have substantially resulted in the “withheld”“withhold” votes.

The Board of Directors will publicly disclose its decision regarding whether to accept or reject such resignation within 90 days following certification of the stockholder vote and shall disclose the reasons therefore.therefor. The Director Election (Majority Voting) Policy is publicly available and can be accessed on the Investor Relations page of the Company’s website at investors.firstcash.com.

Director Independence

The Board of Directors has determined that, with the exception of Messrs. Feehan, Wessel, and Feehan,Rippel, all of its directors, including all of the members of the Audit, Compensation, and Nominating and Corporate Governance Committees, are “independent” as defined by Nasdaq, the SEC and the Company’s Corporate Governance Guidelines. No director is deemed independent unless the Board of Directors affirmatively determines the director has no material relationship with the Company. In making its determination, the Board of Directors observes all criteria for independence established by the rules of the SEC and Nasdaq.

Oversight of Risk Management

The Board of Directors is responsible for overseeing and monitoring the material risks facing the Company. In its oversight role, the Board of Directors regularly reviews the Company’s strategic initiatives, which address, among other things, the risks and opportunities facing the Company. The Board of Directors also has overall responsibility for executive officer succession planning and reviews succession plans from time to time. The Board of Directors has delegated certain risk management oversight responsibility to its committees. committees, and primarily the Audit Committee.

As part of its responsibilities, set forth in its charter, the Audit Committee is responsible for discussing with management the Company’s major risk exposures, including financial risks and cybersecurity, and the steps management has taken to monitor and control those exposures, including the Company’s risk assessment and risk management policies.

The Audit Committee also monitors the Company’s compliance with legal and regulatory requirements and the risks associated therewith. On a regular basis, the Audit Committee reviews with senior management significant areas of risk exposure, including financial reporting controls, operational risks, pending

litigation, employee issues, cybersecurity, disaster recovery planning, and issues arising from complaints to the Company’s hotline and other risk detection mechanisms.

Cyber and Technology Risk

Given the Company’s status as a pawn store operator and payment solutions company entrusted with the safeguarding of sensitive customer information, the Board of Directors believes that a strong enterprise cybersecurity program is vital to the Company’s overall enterprise risk management. The Board of Directors is responsible for overseeing and monitoring the material risks facing the Company. The Board of Directors has tasked the Audit Committee with leading the Company’s cyber and technology risk mitigation efforts. As part of its oversight responsibilities, the Audit Committee is responsible for discussing with management the Company’s major risk exposures related to cybersecurity and technology, and the steps management has taken to monitor and control those exposures, including the Company’s risk assessment and risk management policies. The Audit Committee also monitors the Company’s compliance with legal and regulatory requirements and the risks associated therewith. On a regular basis, the Audit Committee reviews with senior management significant areas of risk exposure involving cybersecurity.

At the direction of the Audit Committee, the Chief Information Officer (the “CIO”) and his team (the Security Incident Response Team, or “SIRT”) monitor internal and external cybersecurity threats and review and revise the Company’s cybersecurity defenses on an ongoing basis. The Company’s CIO, together with other members of the SIRT, bring a wealth of expertise to their respective roles, including expertise in security technologies; designing and implementing security strategies; security standards such as NIST, ISO, COBIT and ITIL; and risk management and incident response. The CIO prepares reports on IT general controls and cybersecurity metrics for the Audit Committee on a regular basis, and the CIO presents those reports to the Audit Committee and addresses any questions and concerns raised by the Audit Committee. At least annually, the Audit Committee meets with the CIO in person to discuss cybersecurity in greater detail. The Audit Committee reports to the Board of Directors regarding cybersecurity matters, and the Board of Directors addresses cybersecurity issues either directly with management or through the Audit Committee.

Compensation Programs

The Compensation Committee reviews the risks and rewards associated with the Company’s compensation programs. With the assistance of Pay Governance, an independent compensation consulting firm, the Compensation Committee designs compensation programs with features that mitigate risk without diminishing the incentive nature of the compensation. While these performance-based compensation and equity programs have been designed and administered in a manner that discourages undue risk-taking by employees, the Compensation Committee believes these programs create appropriate incentives to increase long-term stockholder value. The Compensation Committee has discussed the concept of risk as it relates to the compensation programs and the Compensation Committee does not believe the compensation programs encourage excessive or inappropriate risk takingrisk-taking for the following reasons:

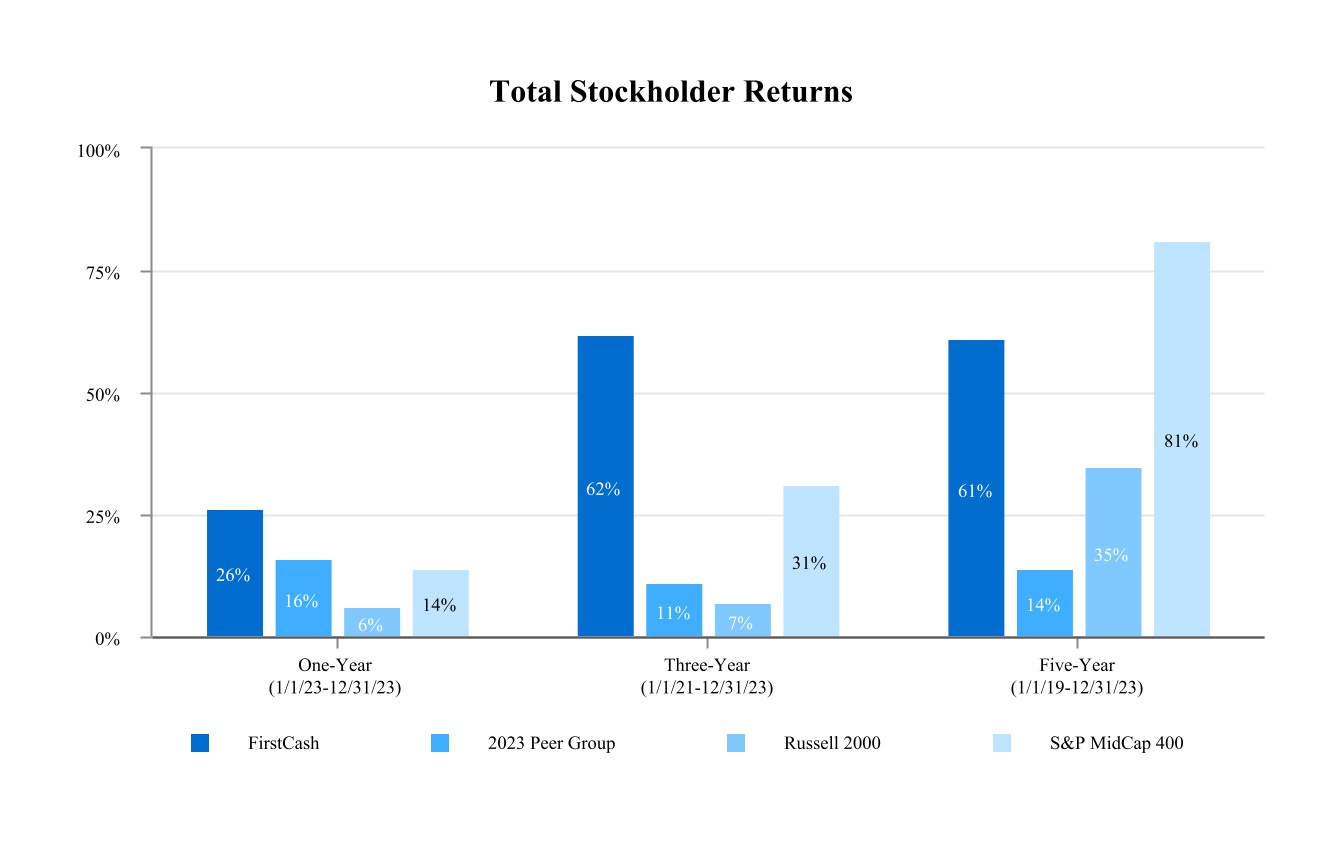

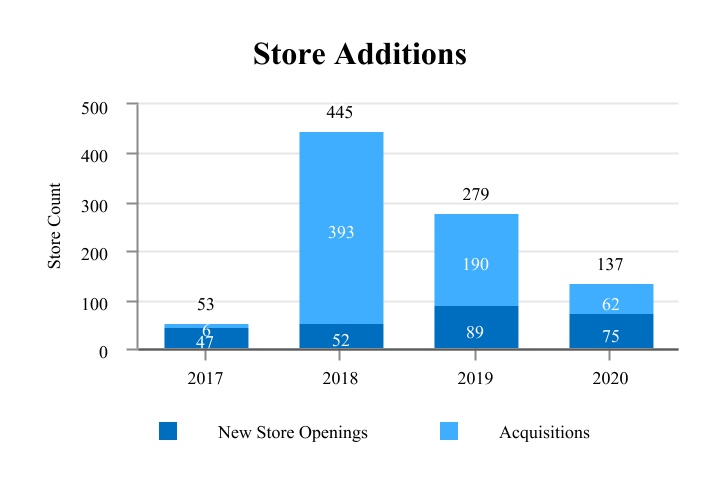

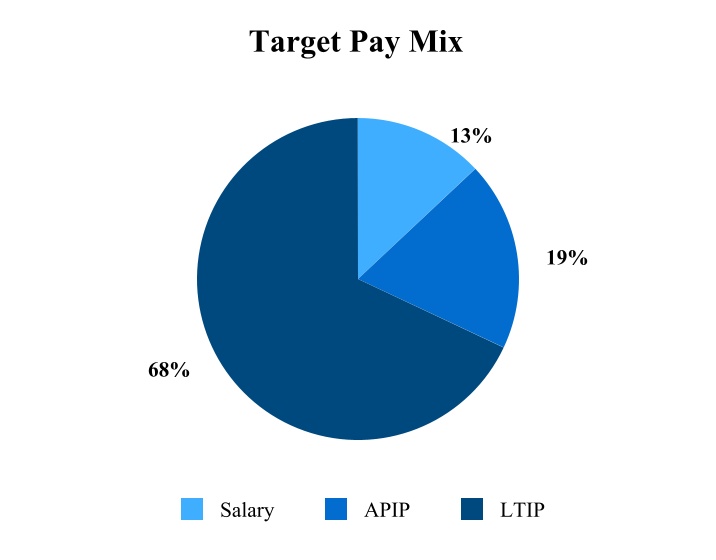

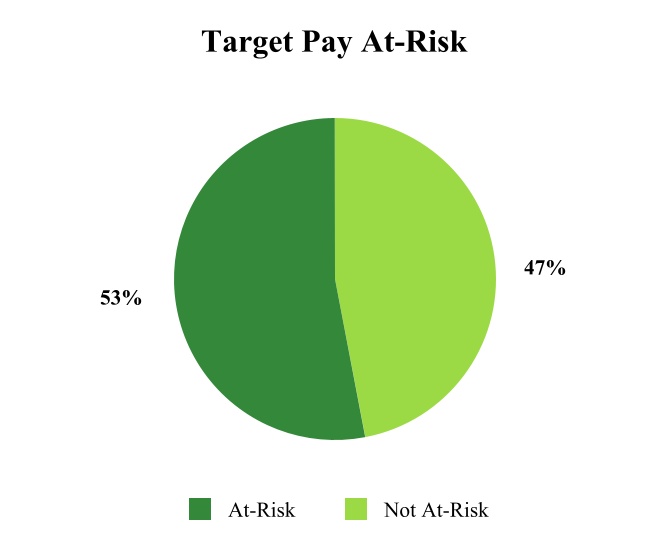

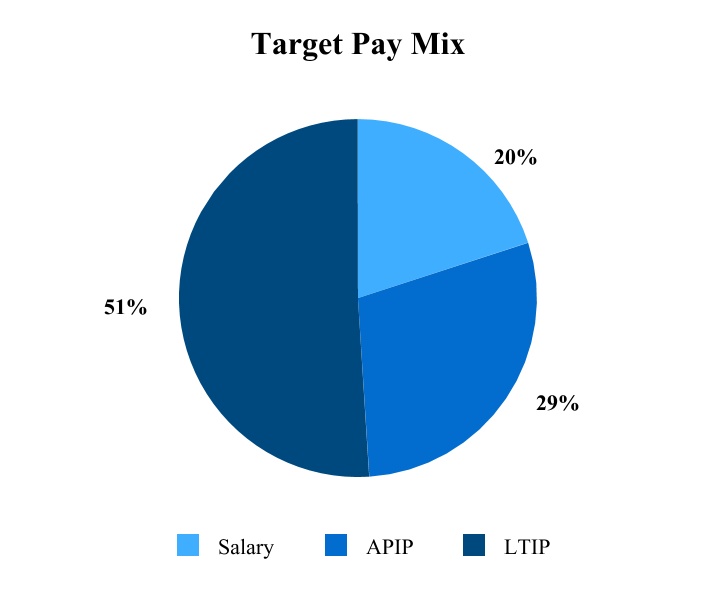

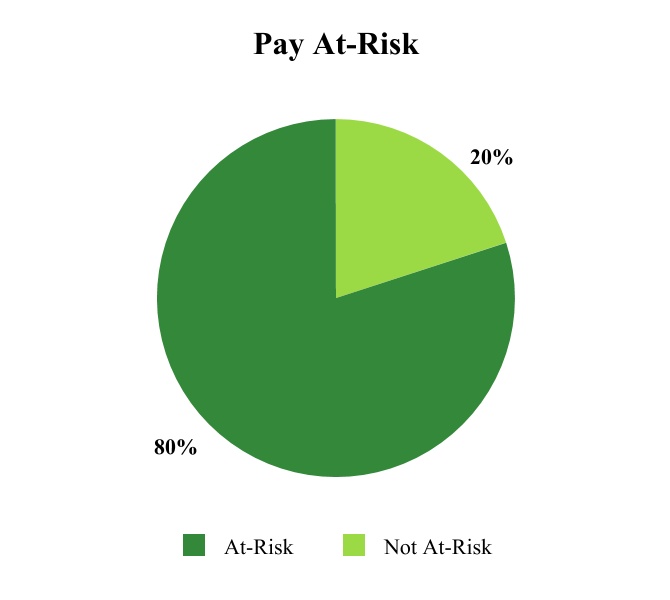

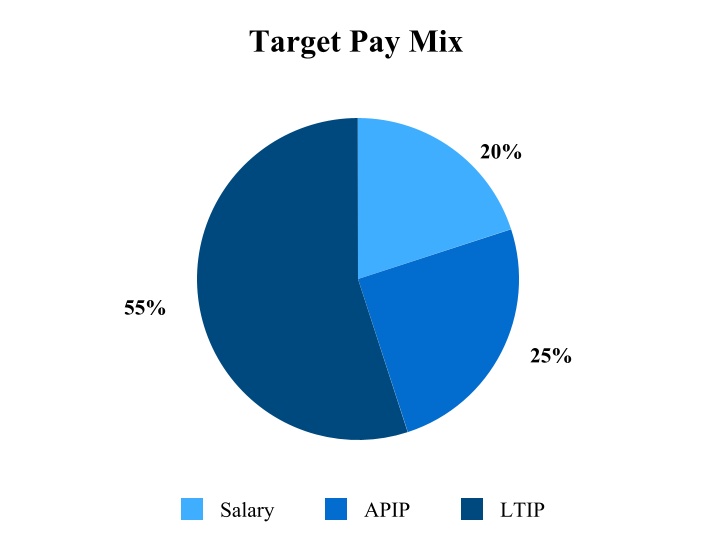

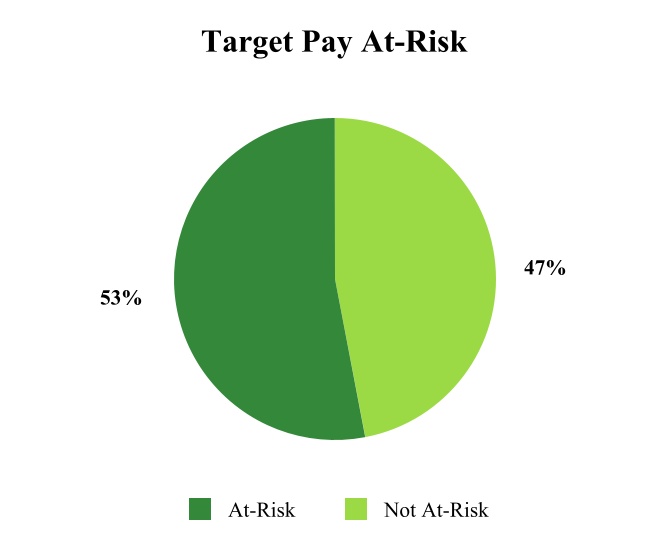

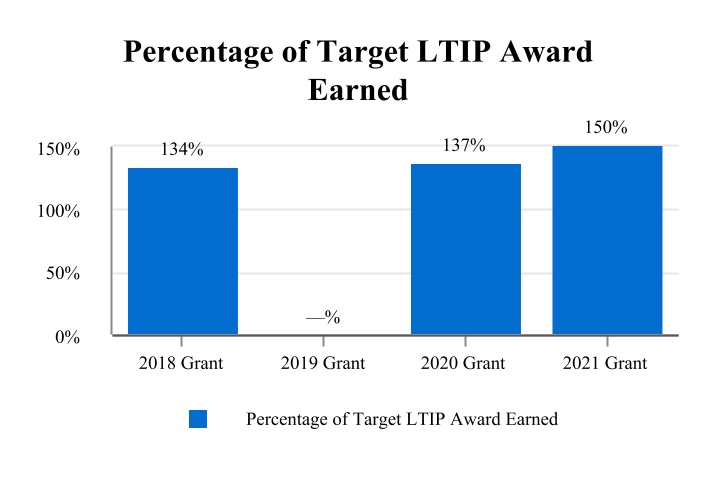

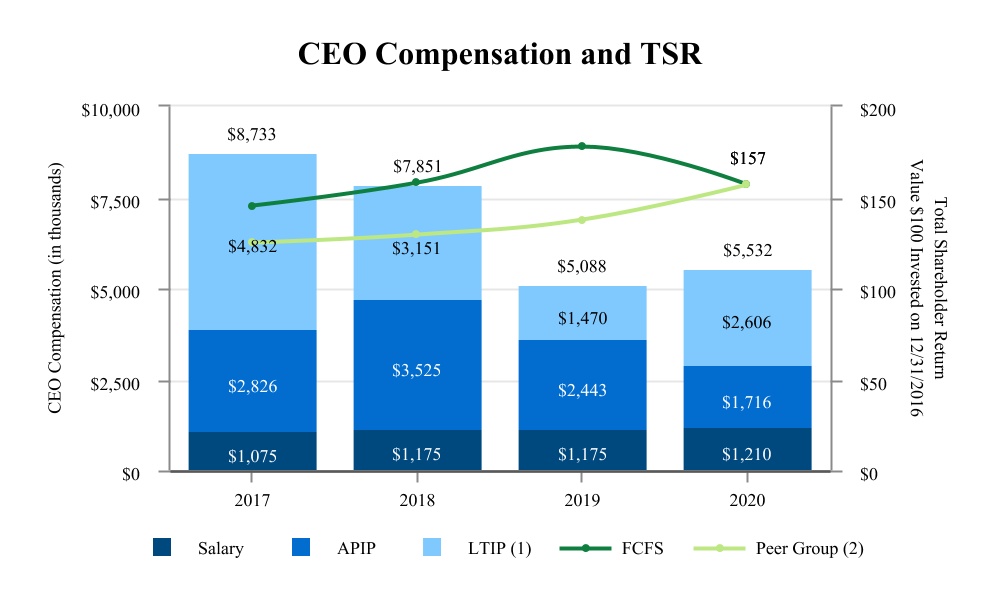

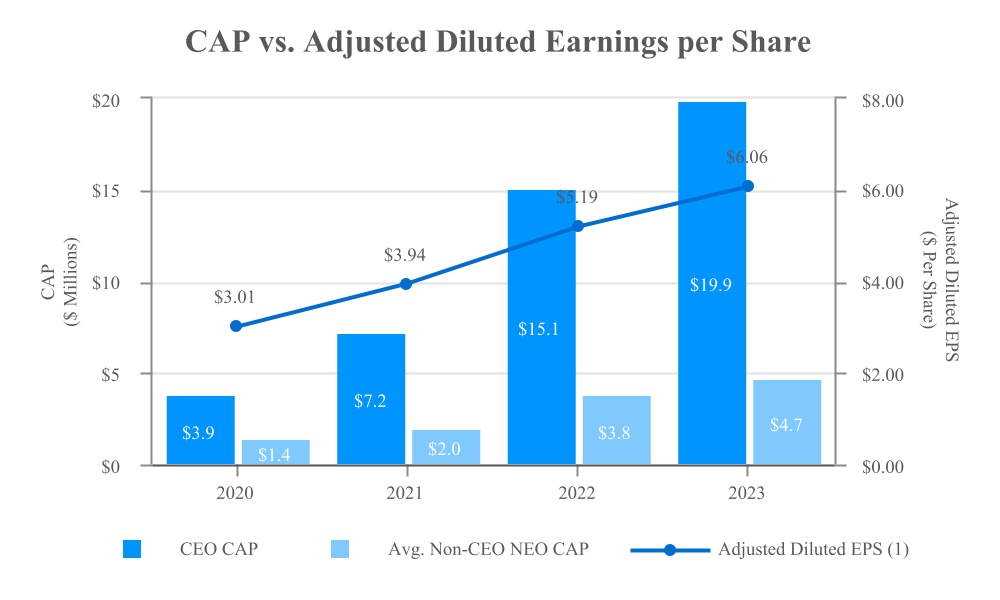

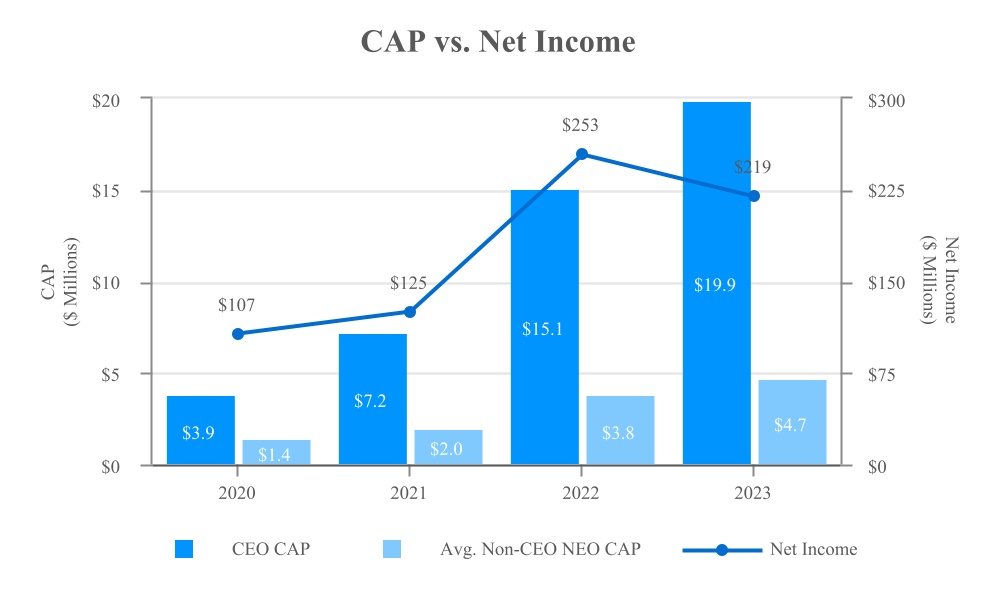

•The Company structures its pay to consist of both fixed and variable compensation. The fixed portion of compensation (salary) is designed to provide a steady income independent of the Company’s stock price performance so that executives do not feel pressured to focus exclusively on short-term stock price performance to the long-term detriment of other important business decisions and metrics and are not encouraged to take unnecessary or excessive risks to achieve corporate objectives. The variable portions of compensation (incentive-based(performance-based cash and equity awards along with time-based equity awards) are designed to reward both short- and long-term corporate performance. For short-term performance, the Company utilizes annual incentive-based cash awards that are based primarily on achieving a combination of revenue and earnings metrics. The metrics are set annually by the Compensation Committee and approved by the Board of Directors. For long-term performance, the Company grants restricted stock awards with a multi-year vesting period primarily tied to the achievement of long-term earnings metrics and store growth targets. Beginning in 2020, thetotal stockholder return (“TSR”). The Company addedalso grants a three-year cumulative relative total shareholder return (“TSR”) metric totime-based restricted stock award as part of its long-term incentive plan and, beginning in 2021, added a one-year relative TSR metric to its annual incentive plan. The Company believes these variable elements of compensation are a sufficient percentage of overall compensation to motivate executives to produce both superior short- and long-term corporate results.

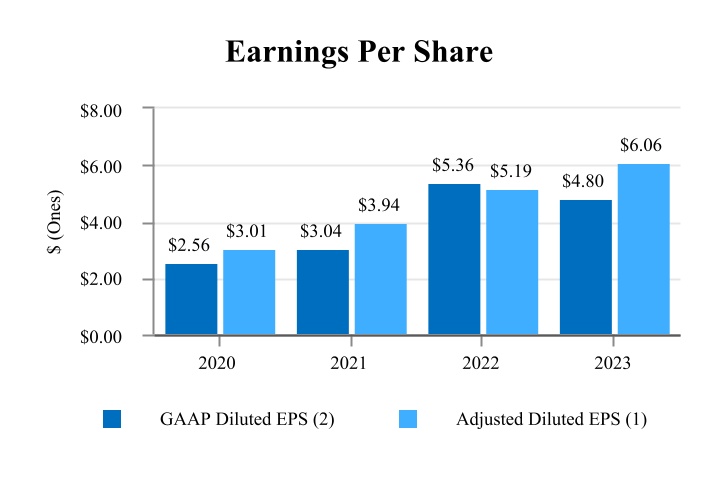

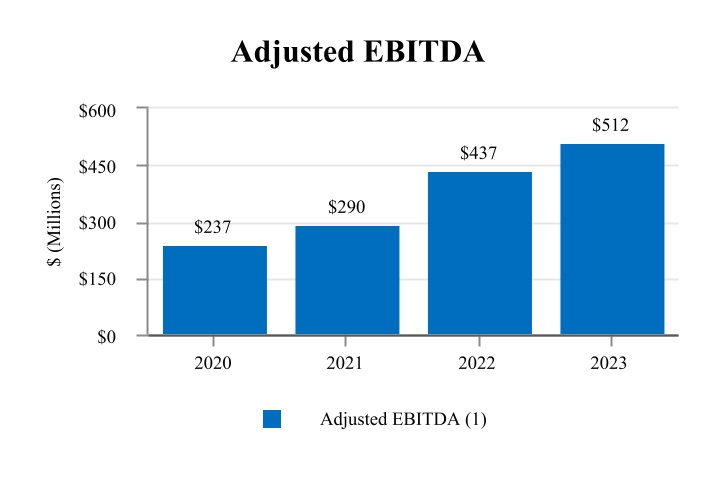

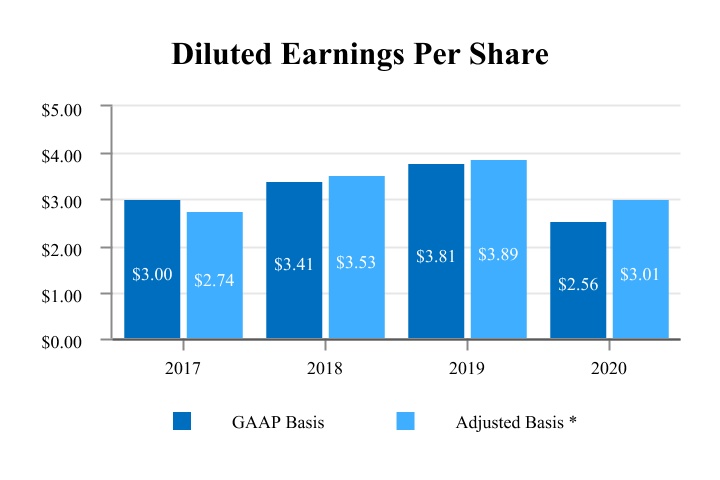

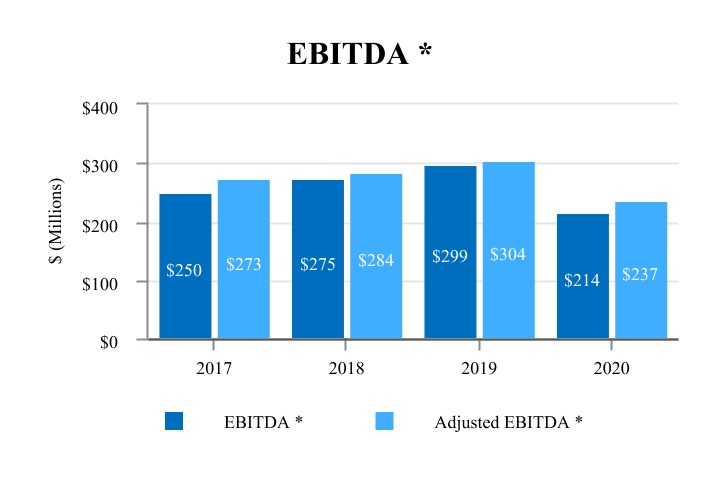

•Because earnings targets, such as adjusted EBITDA, adjusted net income, and adjusted diluted earnings per share, adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted gross net revenue (gross profit) and relative TSR are significant performance elements used for determining incentive payments, the Company believes its executives are encouraged to take a balanced approach that focuses on corporate profitability, rather than other measures which may incite management to drive sales or growth targets without regard to cost or profitability.

•The Company caps cash payments for the goals under its annual incentive plan and caps the number of restricted stock unitsawards granted under its long-term incentive plan, which the Company believes also mitigates excessive risk taking.risk-taking. Even if the Company dramatically exceeds its targets, annual incentive payouts and stock grants are limited by such caps. Conversely, the Company has a floor on earnings and growth targets so that performance below a certain level (as approved by the Compensation Committee) does not result in annual incentive payouts or vesting of performance-based stock grants.awards.

•The Company’s incentive compensation programs have utilized meaningful earnings and growth targets for many years and the Company has seen no evidence that this encourages unnecessary or excessive risk taking.risk-taking.

•The Company believes the use of distinct long-term incentive plans, primarily restricted stock unit awards, with performance-based vesting over three years, provides a strong incentive for sustained operational and financial performance and aligns the interests of the Company’s executive officers with those of its stockholders. The addition of relative TSR performance metrics provides even further alignment with shareholders.

•The Compensation Committee has discretion to adjust payouts under both the annual and long-term performance plans to reflect the core operating performance of the business, but it prohibits discretion for payouts above stated maximum awards.

•The Company maintains an executive compensation recovery, or “clawback,” policy in the event that the Company is required to restate its financial statements. Under the policy, the Company may seek recovery of certain short-term or long-term incentive payments or awards granted to the executive officers.

Board Leadership Structure

Mr. Feehan serves as chairman of the Board of Directors, while Mr. Wessel serves in the role of CEO and is also the vice-chairman of the Board of Directors. In addition, Mr. Faulkner serves as the lead independent director, serving as a liaison between the independent directors and management, chairing executive sessions of the non-management and independent directors and consulting with the chairman and CEO on board agendas and meeting materials.

The Board of Directors recognizes the leadership structure and combination or separation of the chairman, lead independent director and CEO roles is driven by the needs of the Company at any point in time. The Board of Directors does not believe there should be a fixed rule as to whether the offices of chairman and CEO should be vested in the same person or two different people, or whether the chairman should be an employee of the Company or should be elected from among the non-employee directors. The needs of the Company and the individuals available to fulfill these roles may dictate different outcomes at different times, and the Board of Directors believes that retaining flexibility in these decisions is in the best interest of the Company and its stockholders.

Director Qualifications

At a minimum, candidates for election or appointment to the Board of Directors must have integrity, be committed to act in the best interest of all the Company’s stockholders and be able and willing to devote the required amount of time to the Company’s affairs, including attendance at meetings of the Board of Directors. The Nominating and Corporate Governance Committee seeks to assure that the Board of Directors is composed of individuals who have experience relevant to the needs of the Company and who have the highest professional and personal ethics, consistent with the Company’s values and standards. Candidates should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Each director must represent the interests of all stockholders.

In recommending candidates, the Nominating and Corporate Governance Committee takes into consideration any criteria approved by the Board of Directors and such other factors as it deems appropriate, including:including the following:

•The extent of the candidate’s educational, business, non-profit or professional acumen and experience;

•Whether the candidate assists in achievingcandidate’s presence on the Board of Directors would contribute to the Company’s mission to achieve a mix of board members that represents a diversity of background, perspectiverepresenting diverse backgrounds, perspectives and experience,experiences, including with respect to age, gender, race, place of residence and specialized experience;

•Whether the candidate meets the independence requirements established by Nasdaq, the SEC and the Company’s Corporate Governance Guidelines;

•Whether the candidate has the financial acumen or other professional, educational or business experience relevant to an understanding of the Company’s business;

•Whether the candidate would be considered a “financial expert” or “financially sophisticated”sophisticated,” as defined by Nasdaq or applicable law;

•Whether the candidate, by virtue of particular technical expertise, experience or specialized skill relevant to the Company’s current or future business, will add specific value as a board member; and

•Whether the candidate possesses a willingness to challenge and stimulate management and the ability to work as part of a team in an environment of trust.

The Nominating and Corporate Governance Committee does not assign specific weights to particular criteria, and no particular criterion is necessarily applicable to all prospective nominees. In addition to the criteria set forth above, the Nominating and Corporate Governance Committee considers how the skills and attributes of each individual candidate or incumbent director work together to create a board that is collegial, engaged and effective in performing its duties.

Although there is no specific policy on considering diversity, the Board of Directors and the Nominating and Corporate Governance Committee take various diversity-related considerations into account in the selection criteria for new directors. The Nominating and Corporate Governance Committee seeks members from diverse professional and personal backgrounds to combine a broad spectrum of experience and expertise with a reputation for integrity. The Board considers gender, race, nationality, language skills and other personal characteristics in this process and the extent to which the prospective nominee helps the Board of Directors reflect the gender, racial, ethnic and global diversity of the Company’s stockholders, employees and customers.

In this regard, the Board of Directors and the Nominating and Corporate Governance Committee are committed to including highly qualified women and individuals from minority groups in the pool of new candidates for membership. During 2020, the Nominating and Corporate Governance worked to identify female candidates to serve on the Board of Directors. As a result of these efforts, the Nominating and Corporate Governance Committee identified a highly qualified female candidate, Ms. Paula Garrett, for consideration as a director. Based on the recommendation of the Nominating and Corporate Governance Committee and the unanimous approval of the full Board of Directors, Ms. Garrett was added to the Board of Directors effective January 1, 2021. The Company’s Board of Directors continues to recognize that it could benefit from adding an additional highly qualified female and/or minority candidate.

The Company’s Board of Directors is currently composed of well qualifiedwell-qualified directors, and each director has the requisite experience, skills and characteristics to serve on the board. Among, or in addition to, the backgrounds and experiences described in “Proposal 1 - Election of Directors” of this Proxy Statement:

•Mr. Feehan, the Company’s chairman, brings over 35 yearshis leadership experience, specifically his experience as chief executive officer of Cash America, his knowledge of the pawn and consumer finance industries and the associated regulatory environments, his experience and background in finance and accounting and his experience as a director chief executive officer and chief financial officer with Cash America andof multiple publicly traded companies, which has given him a deepstrong understanding of the pawn industry and the legacy Cash America business.public company corporate governance.

•Mr. Wessel, the Company’s vice-chairman and chief executive officer, brings over 2530 years of management and executive experience in the pawn industry gained from his roles as chief financial officer, chief executive officer and director of the Company. His deep understanding of the Company’s business and his success in expanding its business has been invaluable to the Board of Directors.

•Mr. Berce brings broad senior executive leadership with significant experience in the consumer finance industry, and functional expertise in corporate finance and accounting, together with service on other public company boards of directors, including Cash America.

•Mr. Faulkner brings broad senior executive leadership and financial experience, including with domestic and multi-national public and private companies in various industries. Mr. Faulkner’s qualifications include direct executive experience in Latin America.

•Mr. Berce brings broad senior executive leadership, significant experience in the consumer finance industry and functional expertise in corporate finance and accounting, together with experience in service on other public company boards of directors, including Cash America.

•Ms. Davis brings significant experience and expertise in public relations, communications and government relations, which are areas of increasing importance to the Company given the current regulatory and media environment.

•Ms. Garrett brings broad senior executive leadership experience along with exceptional strategic and functional business experience in Latin America.

•Mr. Graves brings significant experience in corporate strategy and finance gained from his experience as the managing partner of a management consulting firm and a financial strategy executive, together with meaningful service on the boards of other public companies, including Cash America.

•Mr. Owen brings broad senior executive leadership and financial experience with private and public companies and functional expertise in corporate finance and accounting.

•Mr. Rippel brings over 25 years of experience in both the consumer finance and point-of sale (“POS”) payment solutions industries, including the AFF business, which he founded, owned and operated.

Board Diversity and Refreshment

The Board of Directors and the Nominating and Corporate Governance Committee routinely assess the composition and size of the Board and aim to strike a balance between the knowledge and understanding of the business that comes from longer-term service on the Board and the fresh ideas and perspective that can come from adding new members. While the Company does not have a specific diversity policy, the Board of Directors and the Nominating and Corporate Governance Committee take diversity-related considerations into account and seek a board that includes directors from diverse professional and personal backgrounds with a broad spectrum of experience and expertise and a reputation for integrity. The Board considers gender, race, nationality, language skills and other personal characteristics in this process and the extent to which the Board of Directors reflects the gender, racial, ethnic and global diversity of the Company’s stockholders, employees and customers. As a result of these assessments, the Board has added three new directors since 2021, including two female directors, one of whom is racially diverse.

The following table summarizes certain self-identified characteristics of the Company’s board members. Each term used in the table has the meaning given to it in Nasdaq Listing Rule 5605(f).

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (as of April 26, 2024) |

| Total Number of Directors | | 9 |

| | | | | | | | Did Not Disclose |

| | Female | | Male | | Non-Binary | | Gender |

| Part I: Gender Identity | | | | | | | | |

| Directors | | 2 | | | 7 | | | — | | | — | |

| | | | | | | | |

| Part II: Demographic Background | | | | | | | | |

| African American or Black | | 1 | | | — | | | — | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| White | | 1 | | | 7 | | | — | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Identifying and Evaluating Nominees for Directors

The Nominating and Corporate Governance Committee will utilize a variety of methods for identifying and evaluating nominees for director.director nominees. Candidates may come to the attention of the Nominating and Corporate Governance Committee through current members of the Board of Directors, professional search firms, stockholders or other persons. These candidates will be evaluated at regular or special meetings of the Nominating and Corporate Governance Committee and may be considered at any point during the year. The Nominating and Corporate Governance Committee will also consider properly submittedproperly-submitted stockholder nominations for candidates for the Board of Directors. The procedures to be followed by stockholders in submitting such nominations are set forth in the “Stockholder Proposals” section. Following verification of the stockholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating and Corporate Governance Committee. If any materials are provided by a stockholder in connection with the nomination of a director candidate, such materials will be forwarded to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee may also review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a stockholder.

Procedure for Stockholders and Interested Parties Communications with Directors

The Board of Directors has established a procedure for stockholders and other interested parties to send communications to the Board of Directors. Stockholders and other interested parties may communicate with the Board of Directors generally or with a specific director or the independent directors at any time by writing to the Company’s corporate secretaryCorporate Secretary at the Company’s address,address: 1600 West 7th Street, Fort Worth, Texas 76102. The corporate secretaryCorporate Secretary will review all messages received and will forward any message that reasonably appears to be a communication that deals with the functions of the Board of Directors or the standing committees of the Board of Directors or that otherwise requires the attention of the Board of Directors and the Nominating and Corporate Governance Committee. Communications will be sent as soon as practicable to the director, or group of directors, including the independent directors, to whom they are addressed, or if addressed to the Board of Directors generally, to the chairman of the Nominating and Corporate Governance Committee. Because other appropriate avenues of communication exist for matters that are unrelated to the duties and responsibilities of the Board of Directors, such as general business complaints or employee grievances, communications of such matters will not be forwarded to the Board of Directors. The corporate secretaryCorporate Secretary has the option, but not the obligation, to forward these other communications to appropriate channels within the Company.

Anti-Hedging and Pledging Policies

The Company’s insider trading policy prohibits all of its directors, officers and employees from engaging in “short sales” or “sales against the box” or trading in puts, calls, warrants or other derivative instruments on the Company’s securities. The Board of Directors believes this prohibition further aligns the interests of directors and executives with those of stockholders, facilitates compliance with insider-trading and other applicable laws, and aids in preventing directors and executives from subjecting themselves to an actual or potential conflict of interest with the Company or creating the appearance of such a conflict.

The insider trading policy generally prohibits directors, officers and employees from purchasing Company securities on margin. Borrowing against Company securities held in a margin account or pledging any Company securities as collateral for a loan may be granted, on a case-by-case basis, where the Company determines that such a pledge would not pose a material risk to the Company or its stockholders. In making such a determination, the Company will look at the financial capacity of the director or employee to repay

the loan without resorting to the pledged securities, the value of the Company securities held relative to the total loan amount and the director or employee’s compliance with any applicable stock ownership guidelines.

In particular, the Company has permitted pledges of Company securities held directly or indirectly by the CEO, Mr. Rick L. Wessel and the CFO, Mr. R. Douglas Orr. Each of these pledges secures lines of credit with the amount drawn on such lines of credit as of April 22, 2024 equal to approximately 10% and 5%, respectively, of the value of the total shares held directly or indirectly by Messrs. Wessel and Orr, respectively. Furthermore, Messrs. Wessel and Orr have significant financial capacity to pay any such loans without resorting to the pledged shares and their stock ownership is significantly above what is required under the Company’s stock ownership guidelines. The Company believes that providing these individuals, on a case-by-case basis where such pledges would not pose a material risk to the Company or its stockholders, the flexibility in financial planning without having to rely on the sale of shares aligns their interests with the Company’s stockholders.

Corporate Governance Guidelines

The Company’s Corporate Governance Guidelines, originally adopted in 2016 and most recently revised in April 2020, meet or exceed the listing standards adopted by Nasdaq and are posted on the Investor Relations page of the Company’s website, investors.firstcash.com, and are also available in print upon request to the Company’s corporate secretary.

SUSTAINABILITY AND CORPORATE RESPONSIBILITY

The Company and its senior management team remain committed to environmental sustainability, providing underserved customers with rapid access to capital and operating its business in a manner that results in a positive impact on its employees, communities and the environment.

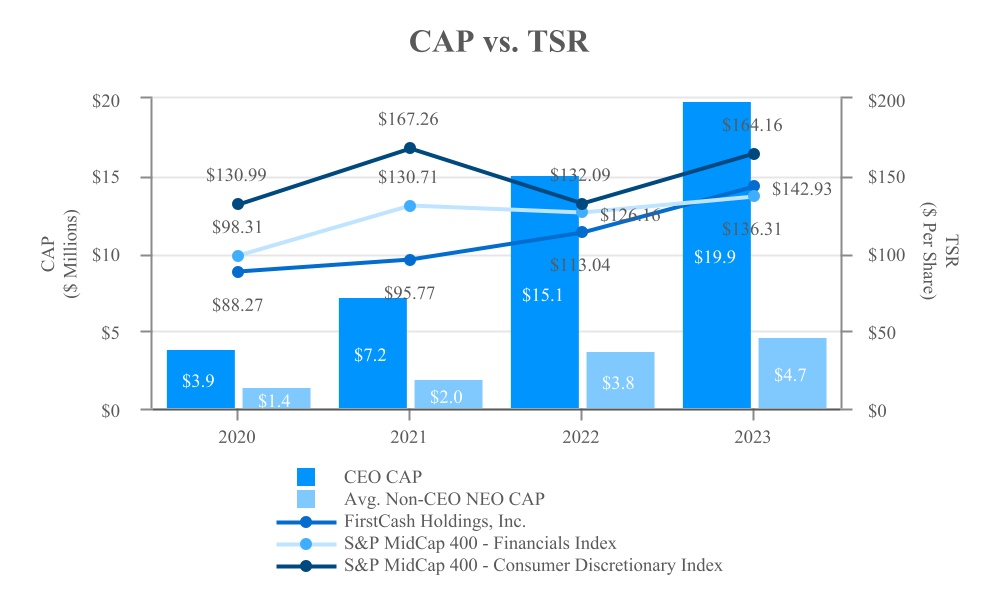

Environmental Sustainability